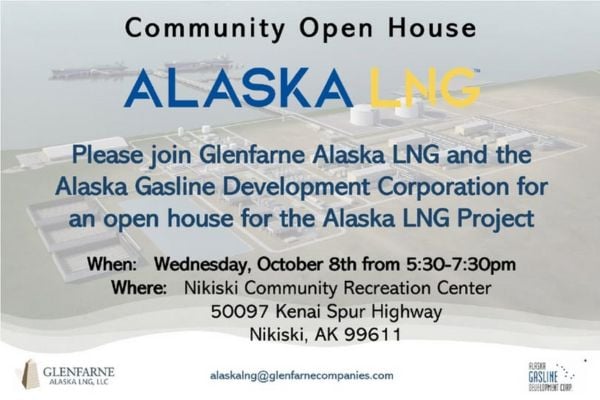

On October 8, the Alaska LNG project will be in Nikiski, presenting its efforts to build an 800-mile pipeline from North Slope gas fields to an export terminal in Cook Inlet. The project’s proponents–the private developer Glenfarne and the state-owned Alaska Gasline Development Corporation–owe Alaskans answers to some fundamental questions–including the very basic one of what their tenuous megaproject will cost and how far the state is obligated to share that cost.

If you’re in the Nikiski area, AKLNG’s Community Open House next Wednesday is an opportunity to seek answers. Before going, here are a few ways to get up to speed on the latest absurdities of Alaska LNG:

- Former business journalist Stan Jones published “Alaska’s Pointless Pipe Dream” in Feb. 2025, a brief whitepaper laying out the project’s bad economics.

- Larry Persily, a former federal coordinator for the pipeline project who’s since become an outspoken critic of it, published an ADN op-ed, “Alaska LNG is digging itself deeper into quicksand” early this month.

- Jones and Persily both presented at a compelling talk in Anchorage on Oct. 1.

Questions Alaskans should be asking about Glenfarne and AKLNG:

- Under what terms has AGDC entered into a partnership with Glenfarne? Specifically:

- What rights and obligations does the state have under the agreement?

- What must AGDC do to retain its 25% stake in the event of a positive investment decision?

- What is the project cost estimated in Glenfarne’s Front End Engineering and Design (FEED) study?

- How does this affect the estimated price of in-state gas delivered via the pipeline?

- Is Glenfarne committed to the Nikiski LNG import terminal it’s building in partnership with ENSTAR, whether or not it invests in the Alaska LNG export project?

- To what degree are the costs of dismantling, removing and remediating the project after its useful life priced into the FEED cost estimate? How is this important responsibility allocated between the state and Glenfarne? What assurance will Alaska have that it is carried out properly at the end of the project’s life?

We would be shocked if AK LNG gave substantive answers to most of these questions in its Nikiski Town Hall. Discovering just what we’re signed up for in the partnership agreement and the cost study will likely take an effort by our legislators when they return to Juneau in January. They should insist that AGDC share its FEED cost estimate and agreement with Glenfarne – and we their constituents should insist on it, too.

The real cost of Alaska LNG

Before this year, the state-owned Alaska Gasline Development Corporation (AGDC) had been Alaska LNG’s sole proponent. In January, AGDC announced that it was giving away 75% of the project to private developer Glenfarne, which would complete the engineering and financial studies necessary for a definitive cost estimate. AGDC had previously failed to raise the $150 million needed for those studies. Glenfarne has said they’ll finish the definitive cost estimate and announce their go/no-go decision on the project by the end of the year.

You’ve probably heard the commonly cited cost estimate of $44 billion for this monstrous megaproject, but independent analysts suspect a more up-to-date price tag could be over $60 billion.

But Alaskans–who remain 25% owners of the project through AGDC–won’t know the actual cost of AK LNG. Glenfarne says it doesn’t intend to make its definitive cost estimate public.

Nor do we know how the rights and obligations of the partnership are distributed between the state and Glenfarne. What role does Alaska’s 25% ownership require it to play if the investment decision goes ahead? What is our off-ramp from the partnership? The agreement between AGDC and Glenfarne is also secret.

Even as Alaska LNG’s economics become more opaque, you’re likely to continue paying for it–if not as an Alaskan, then as a U.S. taxpayer. In addition to the already-existing federal loan guarantee that lowers AK LNG’s borrowing cost, Trump administration officials are now discussing further credit support, possibly from a Biden-era loan program intended for clean energy, as well as requiring Alaska’s military bases to become customers.

Even with every possible subsidy, no project is possible without customers. Glenfarne has had nonbinding agreements or expressions of interest from utilities or state companies in Japan, South Korea, Taiwan, and Thailand. But the one and only reason that Asian LNG buyers are even considering giving this uneconomic project their attention is because of Trump’s nakedly coercive tariff threats. This means that however many billions AK LNG may cost, its real price tag is higher–it includes international trust in our nation as a fair trade partner, a price none of us should be content to pay.